This is how I spend my money

Taking a look at my proposed budget for 2018 and what really happened

Taking a look at my proposed budget for 2018 and what really happened

As an enlightened and savvy effai seeker, I’ve always thought that my spending habits follow a predictable and deliberate 4 step decision process: I Identify what I need; I ensure this item maximizes my utility; I seek out the lowest price. I complete the purchase.

Based on this assumption, I’ve designed a budget and built our entire retirement plan around it. I have categories for all the typical things like rent, and food. I’ve also included things that are usually not considered like taxes and depreciation of assets. I’m quite fond of it really.

Despite maintaining a budget for the past 5 years, I’ve never taken the time to compare my projections to the real world; remember, there’s what you want, and then there’s reality — and they often differ. This year, I’ve decided to do a comparison by category to see how closely we match these projections.

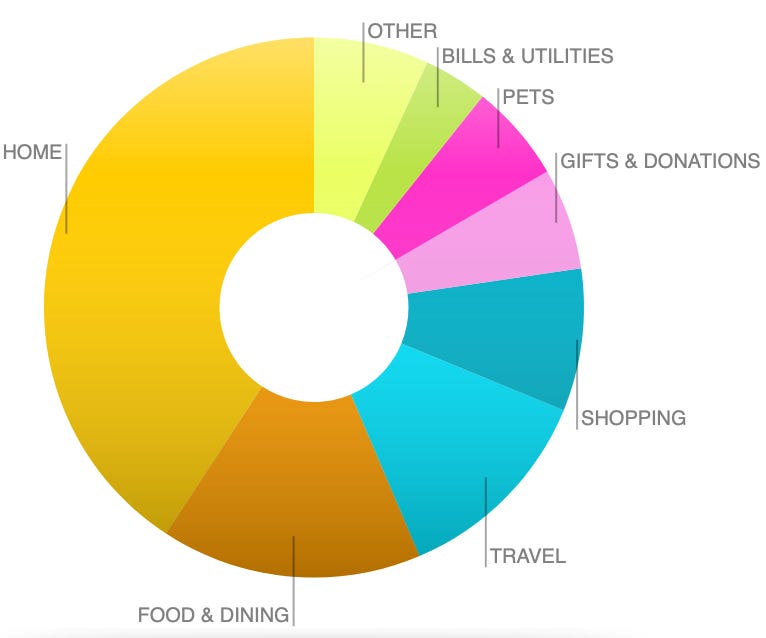

Let’s start with an overview of all categories. This is a breakdown of 2018.

Housing is by far the largest expense category we have — no surprises there. What did surprise me was that food & dining was larger than travel. I will dive into that in a minute, but suffice to say that a large percent of expenses weren’t for groceries. Lastly, I learned that we spend a lot of money on Amazon.

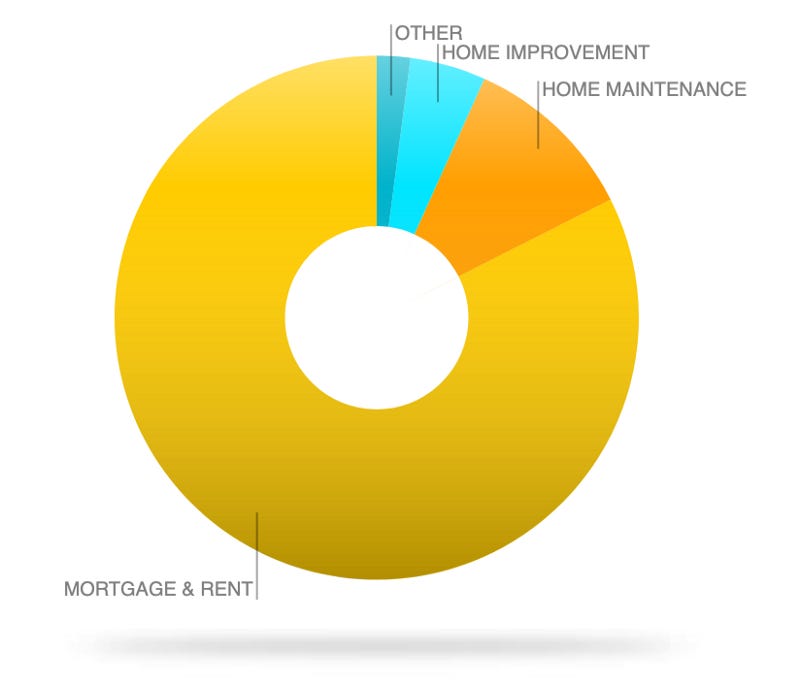

Home

82% of my home expenses are mortgage payments. The rest of the costs are home improvements and maintenance costs. I’ve gone quite a bit over budget in the maintenance category. We had an unexpected sewage issue but those costs should average out over a couple of years.

Food and dining

16% of our spending was on food & dining. Out of that, a little over half was on groceries. The rest was spent on some form of eating out. What surprised me most was how much we’ve spent on coffee shops. This is considering we have a fancy coffee machine at home.

This is certainly an area we can trim back on.

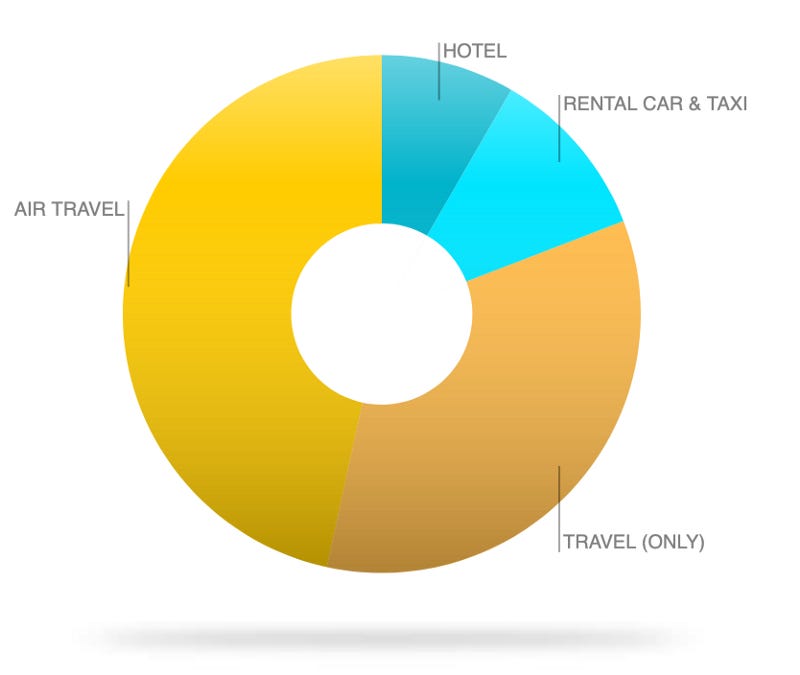

Travel

Travel constituted 12% of our spending. That was well under budget. I don’t consider that a win though. Being under budget on travel can mean one of two things:

I was very savvy with all the miles programs and got us phenomenal deals throughout the year.

We didn’t travel much.

I suspect #2 is closer to reality.

Saving money is great but this year I would like to see some of the coffee money directed towards air travel.

Shopping

Shopping here is a synonym for “Amazon” with a touch of “Target” standing in at 9% of our spending.

Going forward, I will classify the Amazon purchases into more specific categories. We have 113 Amazon transactions — all under the “shopping” umbrella. All Amazon transactions will be manually re-categorized to reflect the actual purchase. It is very likely that by hiding purchases under “shopping”, I am under-estimating other categories.

The rest

The remaining categories add up to a little less than a quarter of our spending. Here are some lessons derived from them:

Aside from the sewage problems, I had two other exceptional charges last year. First, our vet bill was unusually high. Second, we’ve had a second, more traditional wedding. The vet bills are reflected under the “pets” category. The wedding expenses went under the “gifts & donations”. This was a gift for the in-laws (in case you thought I was very generous with charity, now you know).

Of course, given enough exceptions to the budget, a budget for exceptions is necessary.

Second, we spent about $1000 on gas. Considering we barely drive, I was surprised how many times we filled up. Our car usage isn’t as minimalist and efficient as I thought (and claimed).

Finally, when adding up expenses, I had to exclude certain items. For example, we had business expenses related to Airbnb hosting that should not be counted for our day to day spending. Second, all my reimbursable work expenses were mixed in with my regular expenses.

Separating these out was a lot of trouble. Going forward, I have a dedicated bank account for business and a credit card for work related expenses. These will be automatically excluded when I sum up expenses.

Overall, we weren’t too far off (in dollar amount) from what I planned for. That’s a relief. I can be more confident that my plan for financial independence is possible. Also, looking at the big picture of our spending allows me to reconsider my actions and re-evaluate them against my values.

I highly recommend everyone to do this once a year. It can be a really eye opening experience.